PUT AN END TO COLLECTION CALLS AND NOTICES

Bankruptcy is a powerful tool that immediately stops creditors from engaging in collection activities against you. As soon as you file for bankruptcy, the court will issue an order called an "automatic stay," which will stop all collection lawsuits, garnishments, phone calls and notices. This will give you a chance to focus on your financial recovery.

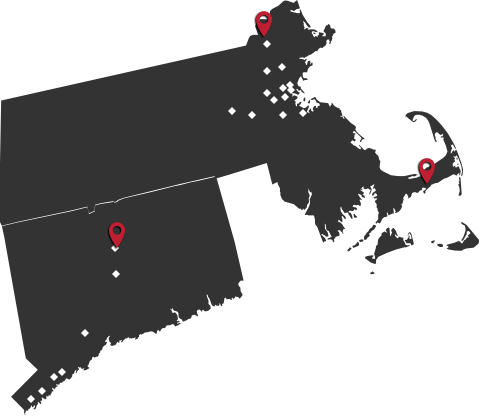

If you are tired of dealing with debt collectors, bankruptcy may be the debt relief solution you've been looking for. At Forghany Law P.C., we can help you determine whether bankruptcy is the right choice for you. Our licensed attorneys have helped hundreds of clients in Massachusetts and Connecticut avoid home foreclosure and get back on their feet by filing for bankruptcy.

Contact us today to schedule a free consultation with one of our friendly Lawrence creditor harassment lawyers.

KEEP YOUR PROPERTY AND STOP YOUR CREDITORS

After the court issues the "automatic stay," it generally lasts until the conclusion of your bankruptcy case. If you file Chapter 7, the stay will probably last four to six months. If you file Chapter 13, the stay will last three to five years.

By filing for bankruptcy, you may be able to put an immediate end to:

- Harassing collection phone calls and notices

- Home foreclosure

- Credit card debt

- Medical debt

- Lawsuits and garnishments

- Property seizure

- Car repossession

- Back taxes and penalties

CONTACT OUR HARTFORD DEBT LAWYERS

Take the first step toward reclaiming your financial future. Contact Forghany Law P.C. to schedule a free consultation. In Massachusetts, we can be reached at

Forghany Law P.C. is a debt relief agency. We help people file for bankruptcy under the Bankruptcy Code.