We Can Help You Maintain Your Lifestyle

People sometimes put off filing bankruptcy because they fear losing the possessions they have worked so hard for or that have sentimental value. People who are deeply in debt often ask our lawyers, "Will I lose everything if I file bankruptcy?" We can reassure you that nearly all debtors are able to keep their jewelry, sports memorabilia and other personal effects after filing bankruptcy.

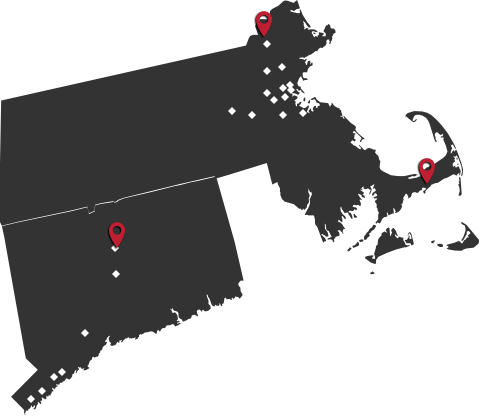

Call Forghany Law P.C. for a free consultation with our bankruptcy attorneys in Lawrence or another one of our convenient locations. We practice throughout the region and can be reached at

Hold On To Your Personal Items And Retirement Accounts

Under the Bankruptcy Code, a significant amount of debtors' assets are protected from creditors. There are some limitations, but our clients are typically able to keep their furniture, family heirlooms, guns and other items. Our attorneys can assess your specific situation and explain how filing Chapter 7 or 13 could affect your assets.

Many debtors are concerned about how bankruptcy will affect their retirement savings. A retirement account is often a person's greatest asset, aside from his or her home. The law protects your 401(k) accounts and IRAs from creditors, so you will not be forced to liquidate your retirement account to repay unsecured debts.

Every situation is different, though, and the bankruptcy laws address different types of accounts in different ways. Our experienced bankruptcy lawyers can provide straightforward answers to your most pressing questions.

Contact Forghany Law P.C.

Our bankruptcy attorneys explain how bankruptcy will affect your property. Serving clients throughout the region, we can be reached at

Se habla español.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.