Missing loan payments on your car, your furniture or any other secured property puts these items at risk of repossession. If you lose the vehicle you rely on to travel to work, your financial situation could become even more challenging. Our bankruptcy attorneys understand the seriousness of this matter, and we can help you find a solution that will prevent repossession.

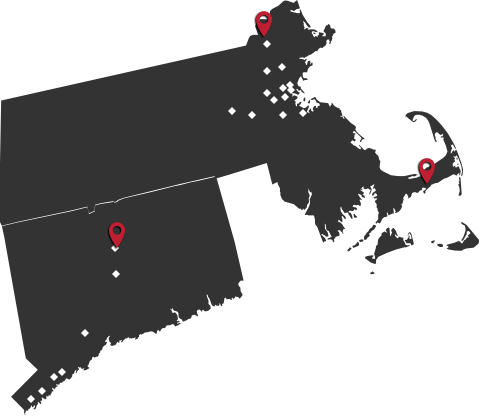

Forghany Law P.C. provides free initial consultations in Lawrence and our many other office locations. To learn more about your options, call our lawyers at

Bankruptcy May Allow You To Keep Your Possessions

We have helped hundreds of clients resolve their debt problems through bankruptcy and other strategies. Sometimes, negotiating a lower interest rate or reduced payment amount is sufficient. Your finances, the terms of the loan and the type of property involved will help us determine the best approach to your case. Debtors often have multiple options with vastly different long-term consequences, so an experienced bankruptcy lawyer is important.

Catch Up On Payments By Filing Chapter 13

Whether you are behind on payments for your car, your appliances or your ATV, filing bankruptcy prevents your property from being repossessed. Filing Chapter 13 allows you to catch up on missed payments and possibly reduce your interest rate or payment amount. You may also have the opportunity to keep your possessions if you file Chapter 7. Our attorneys will examine your circumstances and help you understand your options.

Contact Us For A Free Consultation

We can answer your questions about how bankruptcy stops car repossession. Contact us online or by phone for a free initial consultation. In Massachusetts, call

Se habla español.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.