If you entered your marriage with considerably more debt than your spouse, you may wonder if one spouse can file for bankruptcy as an individual. This issue also arises when one spouse accrues business, medical or credit card debt. The decision for one spouse to file bankruptcy is complicated, but an experienced bankruptcy lawyer can help you choose the strategy that best suits your goals.

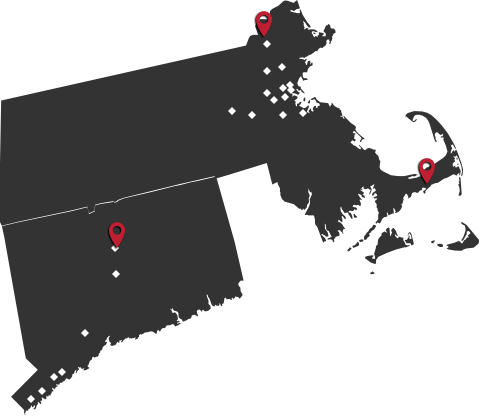

At Forghany Law P.C., our attorneys have assisted hundreds of clients in bankruptcy cases. Call us in Massachusetts (

We Are Committed To Pursuing Your Objectives

Most married couples file bankruptcy jointly, but every situation is unique and this may not be the best option for you and your family. Because our firm focuses on bankruptcy, we have experience helping clients with highly complex financial matters. We will address all of your questions and offer recommendations based on our experience. If you and your spouse are considering divorce, we can explain how the end of your marriage will affect your bankruptcy case.

Bankruptcy May Still Affect Your Spouse

In many cases, one spouse's bankruptcy case will affect the other's finances and credit rating. Filing together may also provide increased protection for your assets. The law does not require one spouse to file with the other, and we can explain the advantages and disadvantages of this option.

Contact Our Firm

During a free initial consultation, we will discuss your debt issues and the options available to you. Contact our knowledgeable attorneys online or call us in Massachusetts at

Se habla español.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.